Outsource Accounts Payable Services for Non-Profit

Outsourcing Account Payable Services For Non-Profit starting from $10/ hour

Account Payable Services is a one-stop solution for all your non-profit accounts payable needs

•Customised Pricing Models

•Improved Customer Service

•Increased Cash Flow

•Qualified Accounting Graduates

•Data Security

•Quick Turnaround Time

Your Trusted Accounts Payable Services Provider for Non-Profit

Account Payable Services is your go-to resource for AP services designed especially for non-profit organizations.

Effective accounts payable management is crucial for non-profit organizations to ensure smooth financial operations and focus on their core missions. At Account Payable Services, we understand the unique challenges faced by non-profits in managing their finances. Limited resources, strict budget constraints, and the need for accountability and transparency make AP management a critical aspect of your organization’s performance. Our dedicated team is here to provide tailored AP solutions that cater to the specific demands of non-profit organizations like yours.

Streamline your AP process with our specialized services for non-profit organizations. We leverage technology, best practices, and deep expertise to enhance accuracy, save time, and reduce administrative burden. From invoice processing to vendor management and compliance, we’ve got you covered.

Collaborating with us empowers your organization to allocate resources effectively, driving meaningful impact and progress. Our expertise in non-profit financial management, coupled with a dedication to personalized and reliable service, positions us as the ideal AP outsourcing choice.

At APS, we prioritize transparency, integrity, and exceptional customer care. By understanding your unique goals and challenges, we deliver tailored solutions that enhance productivity and support your mission-driven initiatives. Trust us to handle your AP processes, allowing your non-profit organization to thrive and focus on making a positive impact in your community.

Things to consider when outsourcing accounts payable

- Effectively plan and direct the outsourcing process.

- Understand the probable monetary and legal risk.

- Get comprehensive knowledge of outsourcing.

- Secure commitment and support from senior management

- Set your purpose and expectations clearly

- Acknowledge the nature of operations that could be outsourced, and the expectations set are met as promised

To discuss your unique requirements and learn more about how we can contribute to the success of your company, get in touch with us right now. Together, we can enable your nonprofit organization to accomplish its objectives and make a significant and long-lasting social effect.

Accounts Payable Outsourcing Services for Non-Profit

- Reconcile Invoices to Orders

- Purchase Order Processing

- Handling Debt Memos

- Standard Pricing Information

- Preparing and Processing AP Aging Reports

- Processing Monthly Account Payable Case

- Processing Monthly Sales Tax

- Reconciliation

- Processing Credit Memos

- Preparing Expense Reports

- Payroll

- Maintaining Historical Records in the System

Outsource Accounts Payable Services to Us

Accounts Payable Process

We Support Multiple Accounting Software

Industries We Serve

- Retail Industry

- Manufacturing Industry

- Restaurant Industry

- Electrical Contractors

- Startups

- Travel Industry

- Dental Practices

- Healthcare Industry

- Information Technology

- Real Estate

- Energy and Utilities

- Transportation Industry

- Nonprofit Organizations

- Education Industry

- Construction Industry

- Law Firms

- E-commerce Industry

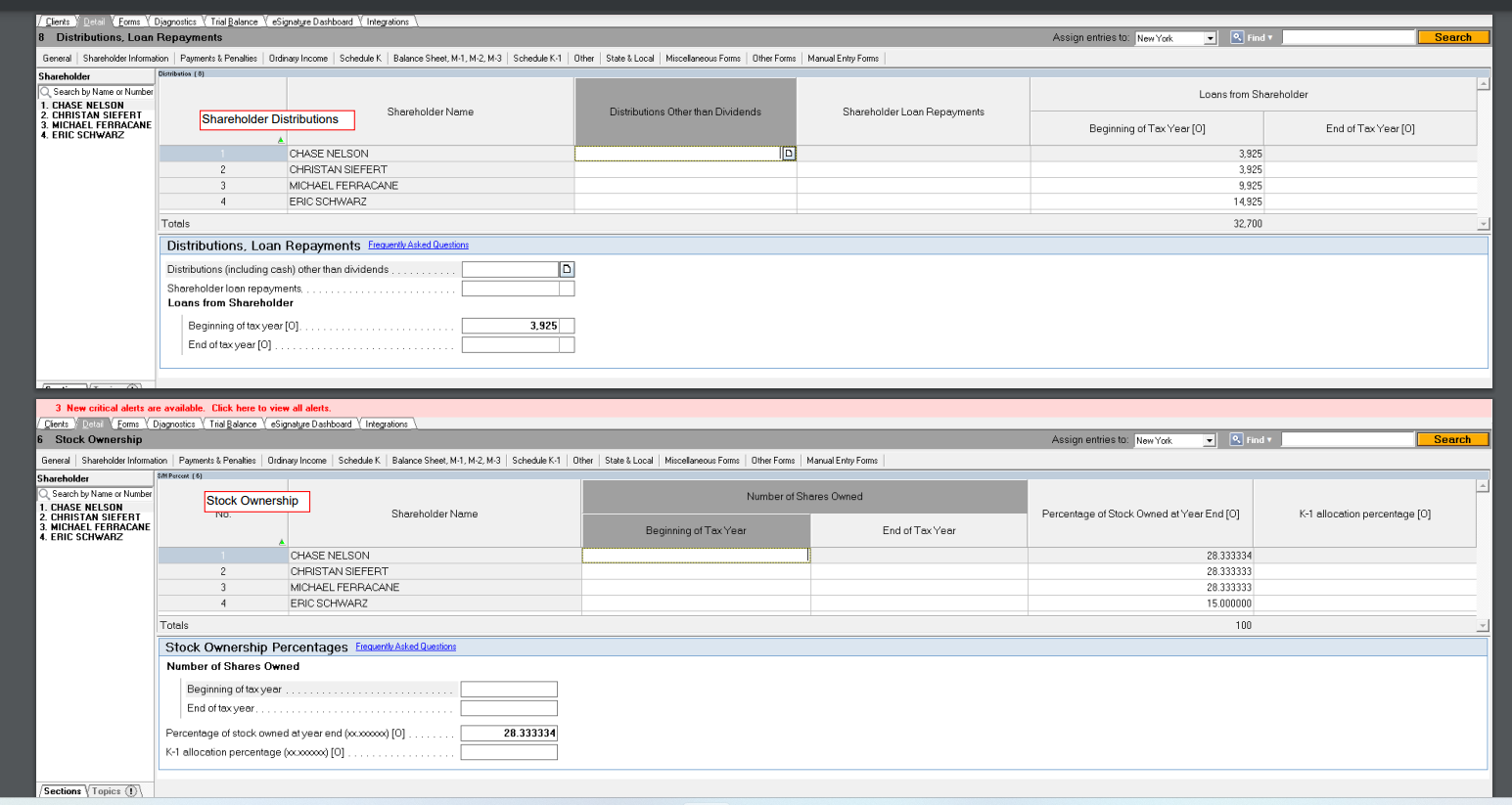

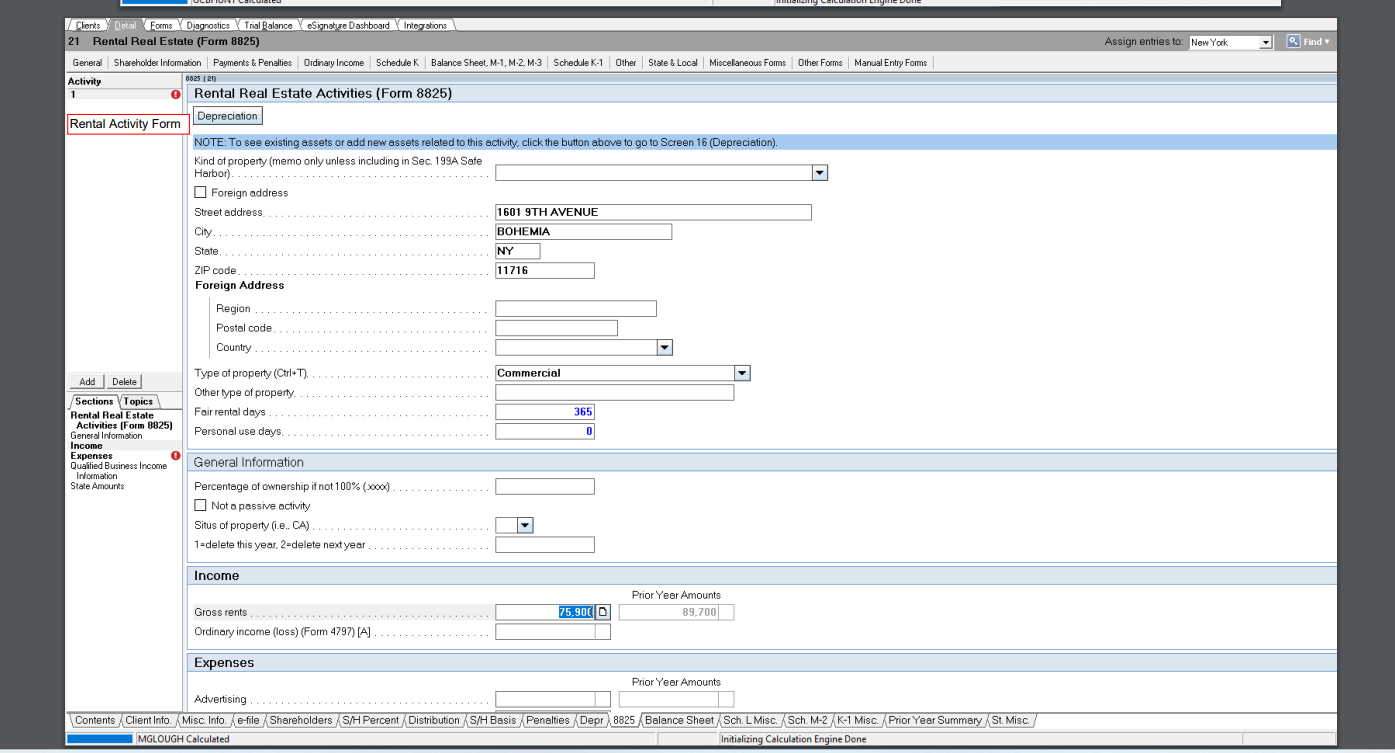

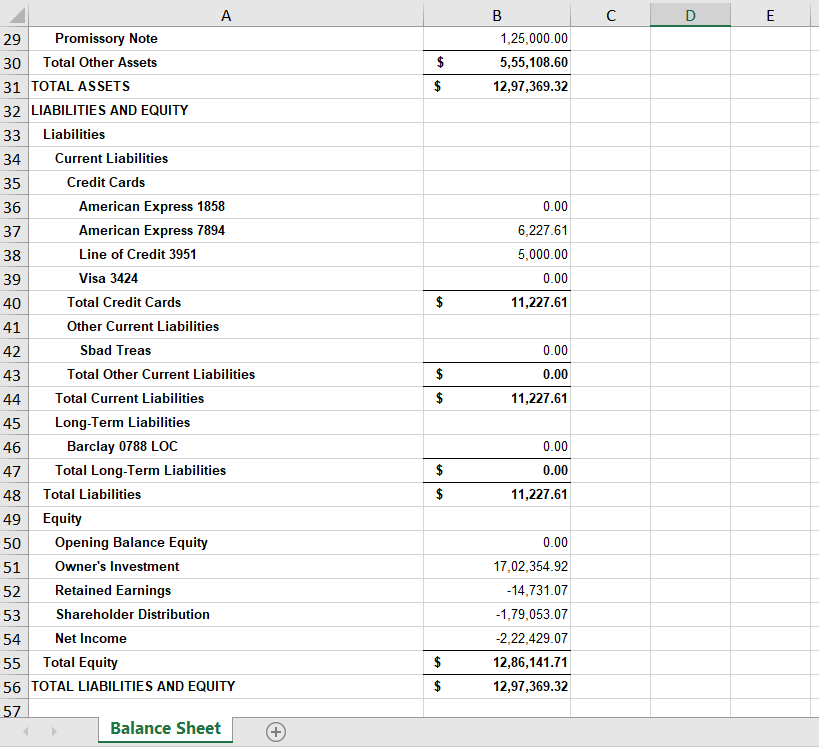

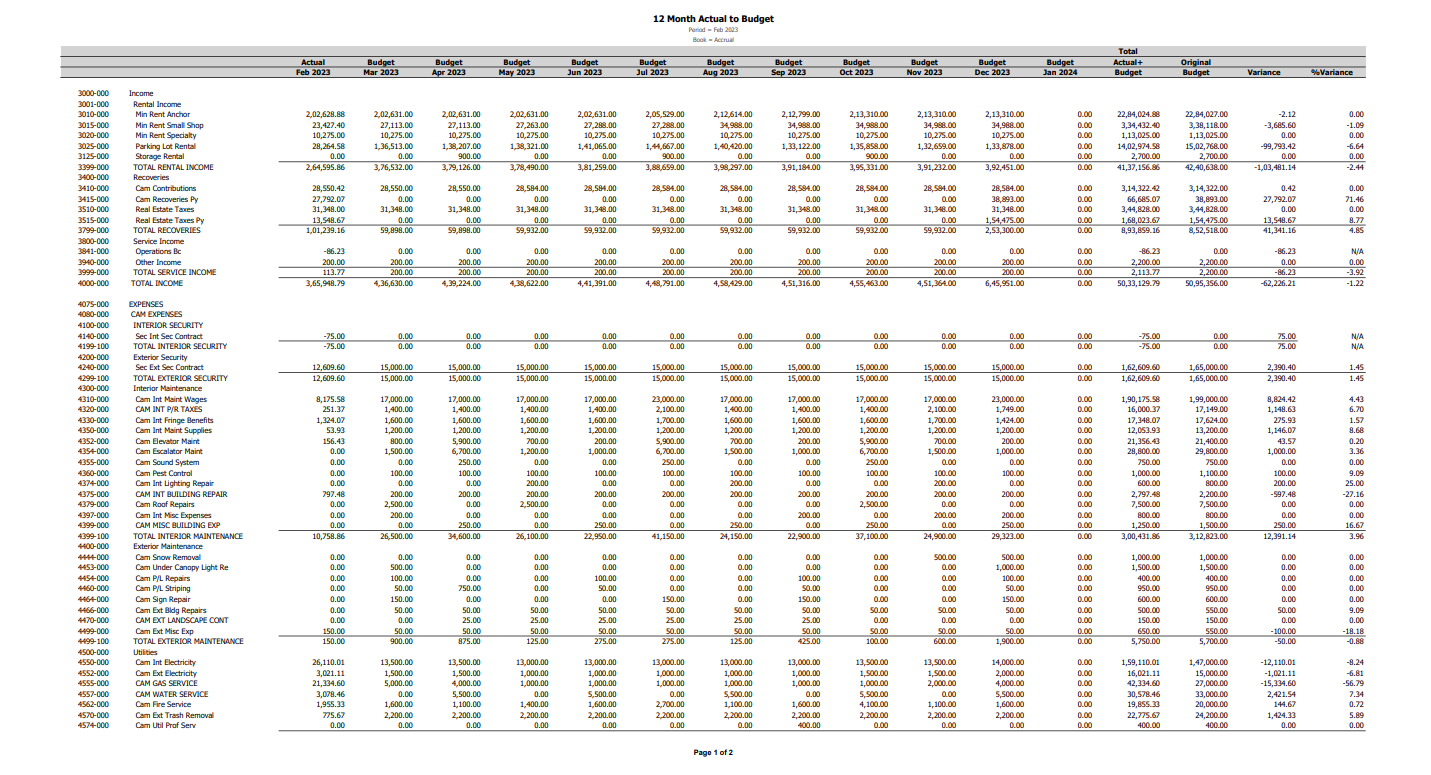

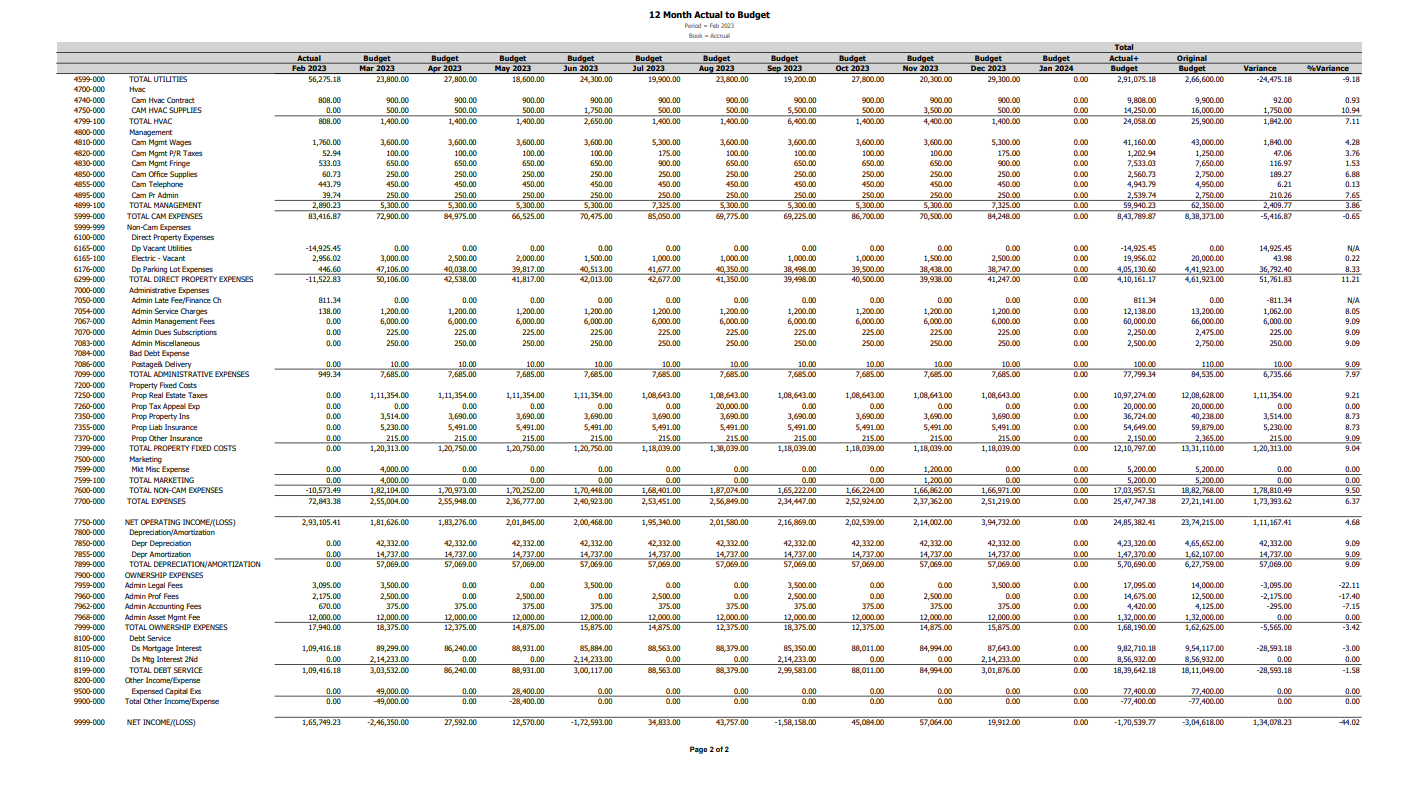

Our Accounting Portfolio

Why Choose APS?

APS has a comprehensive understanding of the financial challenges, reporting needs, and compliance rules unique to this industry. We can offer insightful advice and support tailored to the particular requirements of nonprofit organizations.

Non-profit organizations can save a lot of money by outsourcing their AP needs to APS. Organizations can reallocate their financial resources to support their primary mission and operations by doing away with the need to hire and educate in-house AP staff, handle payroll, and invest in pricey accounting software and infrastructure.

APS uses cutting-edge technology and automated technologies to streamline the AP process, increasing efficiency and accuracy. This shortens payment cycles, improves processing accuracy for invoices, and decreases manual errors. As a result, productivity is increased, turnaround times are shortened, and the incidence of late fees or fines is decreased.

APS has a team of qualified individuals with AP management experience. They are informed on laws, accounting standards, and industry best practices. By outsourcing to APS, you can be certain that your AP operations are managed by professionals who can effectively handle vendor communications, address problems, and guarantee compliance.

APS understands the fluctuating financial dynamics of non-profit organizations, particularly during fundraising peaks and project-specific campaigns. Our services offer the flexibility and scalability required to adapt to your organization’s changing requirements. Whether you have a high volume of invoices or specific customization needs, we can accommodate and tailor our services to suit your unique needs.

APS can improve vendor relationships by ensuring that payments are made on time and correctly. We have procedures in place for handling inquiries from vendors, resolving inconsistencies, and handling payment-related concerns quickly. By doing this, you can keep your vendor relationships strong and benefit from better pricing, deals, and general vendor satisfaction.

APS is aware of the significance of data security and confidentiality, especially for non-profit organizations handling private donor data. We use strong security measures, data encryption, and compliance with privacy laws to protect the financial data of your company.

By contracting with APS for AP services, your organization is free to concentrate on its primary goals and initiatives. You can devote more time and resources to strategic projects, fund-raising campaigns, program development, and other mission-critical work by freeing yourself from the burden of AP management.

APS offers in-depth analytics that gives non-profit organizations a better understanding of their financial operations. These reports can be used to monitor spending trends, spot areas for cost-cutting, and aid in making well-informed choices.

We are aware of the particular requirements of nonprofits and provide committed support to address any issues, make suggestions, and guarantee a positive experience with AP outsourcing.

APS keeps abreast of the most recent regulatory modifications and compliance standards that are unique to the non-profit industry. We ensure that your AP procedures follow all applicable laws, tax rules, and reporting requirements. This lowers the possibility of non-compliance and associated fines.

APS can simply interface with your current accounting software or enterprise resource planning solutions. With this integration, data is transferred without interruption, duplicate entries are stopped, and real-time access to financial data is made possible for better decision-making.

APS can assist in streamlining vendor management procedures by centralizing vendor data, keeping current vendor records, and conducting vendor performance assessments. This guarantees that your business deals with reputable vendors, strikes advantageous terms, and has good vendor relations.

APS employs strong backup systems, data recovery protocols, and disaster recovery strategies to guarantee the continuity of your AP processes even in the case of unanticipated events. This reduces the possibility of data loss and guarantees continuous operations.

The grant-specific AP requirements that APS can help with include tracking expenses, allocating costs to grant budgets, and producing accurate reports for grant compliance and reporting requirements.

APS can assist you in optimizing your vendor payment operations by finding possibilities for early payment discounts, negotiating good payment terms, and putting smart payment scheduling in place. Your organization can benefit from reduced costs and better cash flow management as a result.

APS is dedicated to enhancing the efficacy and efficiency of your AP operations by utilizing best practices and technological innovations. We frequently evaluate our workflows, put automation programs into place, and look for ways to make your AP operations more efficient.

Our Key Differentiators

→Data Security

→High-Quality Services

→Highly Experienced Team

→Customized Pricing Plans

→Dedicated Supervisor

→Improved Customer Service

→24*7 Support

Email Us

Call Us

Get a Free Quote!

FAQs

The management of financial transactions relating to the settlement of invoices and other expenses incurred by a business is the focus of accounts payable services. It entails tasks like processing invoices, managing vendors, making payments, and reporting.

Non-profit organizations can streamline their financial procedures, lighten their administrative load, and ensure accuracy and effectiveness in managing vendor payments by outsourcing AP services. It frees up resources on the inside, allowing the organization to concentrate on its main goal.

Non-profit organizations that outsource their AP functions can enjoy cost savings, more accuracy, quicker payment processing, higher compliance, access to cutting-edge technology and reporting capabilities, and committed assistance from AP management specialists.

It is possible to incorporate streamlined procedures, automation, and best practices by outsourcing AP services to a professional provider. As a result, invoices are processed more quickly, errors are decreased, data accuracy is increased, and vendor payments are made on time.

Reliable AP service providers give the security and confidentiality of sensitive financial data top priority. They use strong security methods like encryption, access limits, and regular data backups to protect data from unwanted access or breaches.

Yes, non-profit organizations can cut costs by outsourcing their AP needs. It does away with the need to hire and train more employees, spend on infrastructure and technology, and oversee continuous maintenance and updates. Additionally, it reduces the possibility of late fines, double payments, and other financial blunders.

AP service providers have adopted vendor management procedures. On behalf of the non-profit organization, they can handle contact and payment queries, keep up-to-date vendor records, and assure accurate vendor information. As a result, seamless vendor interactions and solid vendor relationships are fostered.

Reputable suppliers give access to real-time data and transparent reporting, giving nonprofit organizations visibility and control over their financial dealings. Customized reports and dashboards facilitate improved financial analysis and decision-making.

Providers of AP services are aware of the particular needs and specifications of nonprofit organizations. They provide adaptable solutions to fit specific workflows, budget cycles, grant administration requirements, and reporting requirements. They can modify their offerings to fit the particular procedures and needs of the firm.

To guarantee a seamless transfer, a reliable AP service provider will have a clearly defined deployment methodology. Data migration, system integration, training, and continuing support are frequently involved in this. A successful transition depends on open communication, teamwork, and documentation.