Outsource Accounts Payable Services for Startups

Outsourcing Account Payable Services For Start-Ups starting from $10/ hour

Account Payable Services is a one-stop solution for all your startup accounts payable needs

•Customised Pricing Models

•Improved Customer Service

•Increased Cash Flow

•Qualified Accounting Graduates

•Data Security

•Quick Turnaround Time

Transform Your Accounts Payable with APS: Empowering Startups for Success

We specialize in offering thorough and distinctive account payable solutions that are specially tailored to meet the special requirements of startups. As a dependable partner, we are dedicated to streamlining your cash flow operations so you can concentrate on expanding your company.

We at APS are aware that startups work in a fast-paced, cutthroat environment where every second and every dollar counts. For the sake of preserving financial stability and developing solid vendor relationships, effective accounts payable management is essential. We provide a variety of specialized services designed specifically with startups’ needs in mind. These services include the knowledge, tools, and assistance needed to successfully traverse the complexity of accounts payable management.

A thorough understanding of startup challenges is combined with industry expertise by our team of seasoned professionals. We are aware that resources, time, and experience are sometimes limited for startups. You get a strategic partner in APS who is committed to providing affordable solutions to help you streamline your accounts payable procedures, reduce risk, and promote long-term growth.

Our dedication to providing top-notch customer service makes us unique. We value establishing enduring, solid relationships with our clients. Our devoted support staff is here to respond to your questions, offer tailored guidance, and guarantee that your accounts payable operations go without a hitch. Your success and satisfaction are our top priorities.

Things to consider when outsourcing accounts payable

- Effectively plan and direct the outsourcing process.

- Understand the probable monetary and legal risk.

- Get comprehensive knowledge of outsourcing.

- Secure commitment and support from senior management

- Set your purpose and expectations clearly

- Acknowledge the nature of operations that could be outsourced, and the expectations set are met as promised

Find out how APS can change the way your accounts payable operations operate. Allow us to manage the difficulties, simplify your procedures, and improve your financial operations so you can concentrate on expanding your firm. To find out more about how APS can help your startup succeed, get in touch with us right away.

Accounts Payable Outsourcing Services for Startups

- Reconcile Invoices to Orders

- Purchase Order Processing

- Handling Debt Memos

- Standard Pricing Information

- Preparing and Processing AP Aging Reports

- Processing Monthly Account Payable Case

- Processing Monthly Sales Tax

- Reconciliation

- Processing Credit Memos

- Preparing Expense Reports

- Payroll

- Maintaining Historical Records in the System

Outsource Accounts Payable Services to Us

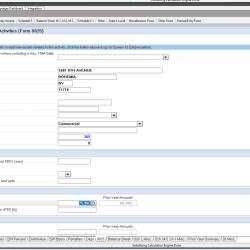

Accounts Payable Process

The first step in this process is to receive invoice receipts from suppliers and vendors and process them. It includes ensuring proper authorization and inputting invoice details into the accounting system.

Once invoices have been processed, the team facilitates the payment procedure. This involves preparing payment schedules, coordinating with the finance department, and issuing payments to suppliers/vendors via cheques, electronic funds transfer (EFT), or online payment platforms.

This step involves keeping supplier/vendor records, updating contact information, resolving inquiries or disputes, and ensuring contractual compliance.

This entails evaluating and processing employee expense reports, confirming supporting documentation, and reimbursing employees for valid business-related expenses.

Accounts payable records must be regularly reconciled to ensure accuracy and financial control. This includes reconciling supplier statements with internal records, identifying discrepancies, and resolving outstanding issues.

This step involves producing periodic reports on outstanding payables, aging analysis, cash flow projections, and other financial metrics for decision-making purposes.

Account Payable Services aid in meeting legal and regulatory documentation requirements. This includes maintaining accurate documentation, adhering to tax regulations, and facilitating audits or internal evaluations of accounts payable processes.

Account Payable Services frequently seeks to enhance efficiency and efficacy through process enhancement. This may entail implementing automation solutions, streamlining workflows, evaluating internal controls, identifying cost-saving opportunities, and optimizing the accounts payable process.

Some accounts payable services extend to include assistance with vendor negotiations. This includes negotiating favorable payment terms, discounts, or pricing arrangements to reduce costs and strengthen supplier relationships.

This includes matching invoices to purchase orders, confirming receipt of products or services, and ensuring proper authorization before processing payments.

When new vendors or suppliers are added, Account Payable Services can manage the onboarding procedure. This entails collecting the essential paperwork, establishing vendor accounts, and ensuring compliance with vendor registration requirements.

This involves investigating and resolving payment discrepancies, coordinating with internal departments and suppliers to resolve disputes, and maintaining positive relationships with vendors.

We Support Multiple Accounting Software

Industries We Serve

- Retail Industry

- Manufacturing Industry

- Restaurant Industry

- Electrical Contractors

- Startups

- Travel Industry

- Dental Practices

- Healthcare Industry

- Information Technology

- Real Estate

- Energy and Utilities

- Transportation Industry

- Nonprofit Organizations

- Education Industry

- Construction Industry

- Law Firms

- E-commerce Industry

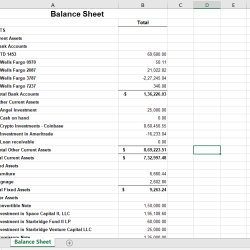

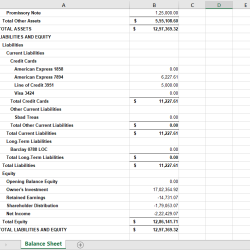

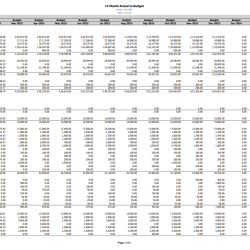

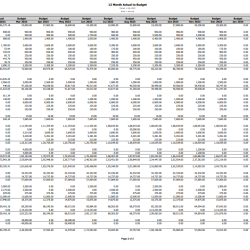

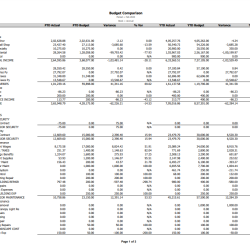

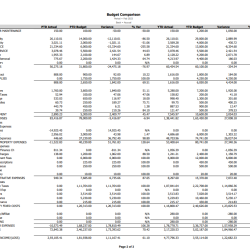

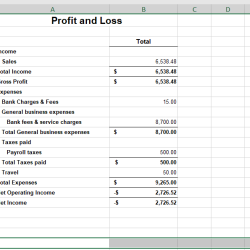

Our Accounting Portfolio

Why Choose APS?

We recognize the unique challenges that startups confront in handling their funds and provide solutions tailored to their particular requirements. Our team is well-versed in the best practices and methods that promote success in this dynamic business climate and has a lot of experience working with startups.

Your operational costs can be greatly reduced by outsourcing your accounts payable services to APS. We can provide cost-effective solutions without sacrificing quality thanks to our streamlined processes, automation capabilities, and economies of scale. We assist startups in making the most of their financial resources so they can devote more funds to important strategic projects and operational tasks.

To simplify the accounts payable process, APS makes use of cutting-edge technologies and automated workflows. We increase efficiency and lower the chance of mistakes by doing away with manual data entry, cutting down on paperwork, and speeding up approval periods. Our team of professionals guarantees precise invoice processing, prompt payment disbursements, and enhanced cash flow management to help startups run more successfully and efficiently.

Transaction volumes and growth rates are frequently erratic for startups. APS offers adaptable solutions that can accommodate your evolving company needs and recognize the need for scalability. Whether you expand into new markets or face a spike in invoice volume, our services can adapt to your changing needs with ease, preserving continuity and improving operational effectiveness.

Your staff can concentrate on its core capabilities, strategic planning, and innovation-spurring initiatives rather than spending hours processing invoices and payments. Our committed experts handle the routine accounts payable activities, freeing your staff to focus on what it does best—growing the company and accomplishing its objectives.

Your financial information’s security and confidentiality are top priorities for APS. We use strong security precautions, put data encryption mechanisms into place, and follow the highest compliance requirements. Startups can reduce security risks, preserve data integrity, and guarantee regulatory compliance by working with APS.

APS has the knowledge and skills necessary to efficiently manage interactions with vendors, respond to questions, and settle disputes. To maintain good relationships with your vendors and guarantee timely and correct payments, we work closely with them. Our vendor management tools simplify the accounts payable procedure, promote fruitful supplier relationships, and advance the success of your startup as a whole.

APS offers thorough reporting and analytics catered to the needs of startups. Startups can take advantage of our reporting tools to get important information about cash flow, vendor performance, and financial metrics. Startups may make well-informed decisions, spot areas for improvement, and promote strategic growth thanks to this data-driven methodology.

At APS, we take great satisfaction in providing first-rate customer service. We assign specialized account managers and support teams to our startup clients to ensure individualized support and rapid resolution of any questions or concerns. We are firm believers in establishing long-term relationships with start-ups, offering ongoing assistance, and serving as a reliable resource as their companies develop.

APS has extensive experience in the accounts payable management field and keeps up with the most recent trends, laws, and best practices. We take advantage of our knowledge to create solutions that adhere to industry standards, as we understand the particular needs and peculiarities of the startup ecosystem. Startups that work with APS gain access to our knowledge and suggestions for improving accounts payable procedures.

Improved cash flow management is essential for the stability and expansion of startups’ finances. APS uses techniques and tools like prompt invoice processing, precise payment scheduling, and effective vendor contact to maximize cash flow. Startups can better manage their financial responsibilities, grasp growth opportunities, and reduce cash flow risks by guaranteeing a continuous and managed cash flow.

APS understands the value of integrating with current workflows and systems. We closely collaborate with startups to enable a seamless transition and integration of account payment procedures. Our team works with your internal IT and finance teams to align systems, reduce disruptions, and ensure data integrity throughout the outsourcing process.

APS serves as a trustworthy middleman, providing rapid communication, precise payment processing, and swift dispute resolution between startups and their suppliers. Our dedication to upholding beneficial vendor connections aids entrepreneurs in building trust, negotiating advantageous terms, and gaining access to the best goods and services for their businesses.

By working with APS, entrepreneurs have access to sophisticated tools and technology for accounts payable that would otherwise be expensive to install on their own. We use automation, digitalization, and AI-driven solutions to speed up procedures, increase precision, and boost productivity. Even with limited internal resources, companies may stay on the cutting edge of accounts payable administration thanks to this technology-driven strategy.

APS provides adaptable price structures that precisely address the financial limitations of startups. We are aware that entrepreneurs need affordable solutions that fit their budgetary constraints. Our flexible pricing structures enable startups to pay for the services they require and quickly adapt as their company expands. It guarantees that startups can obtain top-notch account payable services without paying more.

We routinely review the account payable process, locate any bottlenecks, and put productivity-boosting measures into place. Our proactive strategy guarantees that startups gain from continual account payable process optimization, generating sustainable long-term value.

APS delivers strategic financial insights to startups in addition to regular accounts payable services. We undertake an analysis of the accounts payable data and offer insightful information on cost trends, vendor performance, and financial trends. This data-driven strategy helps businesses make informed decisions, find opportunities for cost savings, and increase their overall financial success.

For startups, it’s critical to focus on compliance with financial regulations and audit standards. Your accounts payable procedures will be compliant with legal requirements and audit-ready thanks to APS. We develop internal controls, keep accurate records, and provide supporting paperwork to ensure financial transparency. Startups can handle regulatory complexity and be well-prepared for audits by working with APS.

Startups can free up significant time and resources by outsourcing to APS, enabling their staff to concentrate on key company operations. Employees can now focus their efforts on strategic projects, customer satisfaction, and corporate growth, which boosts productivity.

Startups frequently go through a period of rapid growth and expansion. Scalable solutions from APS are available to meet the rising needs of expanding businesses. Our accounts payable services can smoothly adapt to suit your changing demands when you enter new markets, enroll more vendors, or handle larger transaction volumes. This adaptability ensures that even during times of expansion, your accounts payable operations are functional and efficient.

For startups, fraud and errors in accounts payable can have a big financial impact. APS has put in place strong control systems to identify and stop errors and fraud. We assist in protecting your startup’s financial interests and reducing the danger of financial losses due to fraud or mistakes through stringent checks, validations, and reconciliation processes.

Our team offers individualized attention and support as an extension of your finance department. They are knowledgeable about the accounts payable procedures and readily available to answer your questions, address problems, and offer direction. You have a dependable and approachable team at APS to help you with your accounts payable journey.

APS seeks to be more than a simple provider of outsourced services. We aspire to be a strategic partner for entrepreneurs, providing direction and assistance as they work toward their growth goals. Our team works with you to comprehend your company’s objectives, difficulties, and chances. With an eye toward your startup’s growth trajectory, we offer proactive solutions, industry insights, and strategic advice.

As technology advances, APS continues to lead the field in account payable innovations. To improve our service offerings, we constantly adapt to new technological developments. Startups can utilize cutting-edge technology, automation solutions, and digital platforms that enhance accounts payable procedures and increase efficiency by collaborating with APS.

APS is well-known in the sector for providing dependable and superior accounts payable services. Our track record of accomplishments and happy customers is evidence of our dedication to quality. Businesses in the startup stage can rely on APS to conduct their accounts payable procedures with the utmost professionalism, precision, and honesty.

Our Key Differentiators

→Data Security

→High-Quality Services

→Highly Experienced Team

→Customized Pricing Plans

→Dedicated Supervisor

→Improved Customer Service

→24*7 Support

Email Us

Call Us

Get a Free Quote!

FAQs

By outsourcing accounts payable services, startups can benefit from specialized knowledge, cut expenses, increase efficiency, and concentrate on their primary operations. It ensures entrepreneurs gain access to expert assistance, cutting-edge technology, and scalable solutions without having to make substantial infrastructure investments or hire more people.

Account payable services outsourcing can help startups save a lot of money. It does away with the requirement for internal staff, lowers operating costs, decreases mistakes, and improves cash flow management. Furthermore, outsourcing gives companies access to swift payment procedures, advantageous vendor terms, and strategic financial insights that support monetary stability and expansion.

No, it’s advantageous for startups of all sizes to outsource accounts payable services. Outsourcing allows you to scale up and down to meet your changing demands, regardless of how big or small your startup is. Service providers like APS provide tailored solutions that fit the particular needs of startups, ensuring you get the right kind of assistance and knowledge.

Reputable accounts payable service providers prioritize data security and use strong safeguards to guard against unauthorized access to confidential financial data. They use encryption, abide by tight confidentiality standards, and follow security processes that are among the best in the industry. Startups can reduce security risks and guarantee compliance with data protection laws by working with a dependable service provider like APS.

No, outsourcing accounts payable functions does not entail a loss of financial management for your startup. In reality, it can improve visibility and control. Startups can retain supervision and make wise financial decisions if they have access to real-time data, accessible reporting, and regular communication. Startups can concentrate on strategic planning while using outsourcing to get accurate and timely financial information.

By automating manual processes, getting rid of paperwork, and lowering the possibility of mistakes, outsourcing account payable services streamlines operations. Startups can take advantage of expedited invoice processing, quicker approval cycles, and prompt payment disbursements thanks to it. Startups can increase productivity, lessen administrative stress, and streamline their processes by working with an experienced service provider.

Outsourcing accounts payable services can help you achieve the growth goals of your startup. Service providers like APS offer scalable solutions because they are capable of handling rising transaction volumes, market expansion, and changing client needs. Startups can concentrate on scalability and strategic growth strategies by utilizing their knowledge, technology, and industry insights.

The evaluation of the particular needs and objectives of your startup usually comes first in the outsourcing process. The service provider will next produce a personalized strategy that addresses your needs and specifies the range of services, the timing of execution, and the key performance indicators. Data migration, process setup, and communication channel creation are all parts of the transition process. Once put into place, the service provider oversees ongoing responsibilities related to the accounts payable while continuing regular communication and reporting with your startup.

Trustworthy service providers are aware of how crucial integration with current workflows and systems is. To guarantee that accounts payable operations are seamlessly integrated, they regularly collaborate with startups. The service provider guarantees interoperability, data integrity, and minimal operational disruptions by working with your internal IT and finance teams.

To assess the effectiveness of outsourcing accounts payable services, key performance indicators (KPIs) like cost savings, process efficiency, error reduction, and vendor satisfaction can be used. Additionally, open lines of communication, transparent reporting, and defined feedback procedures with the service provider will give you information on the caliber, responsiveness, and alignment of the service with the objectives of your startup.