Outsource Accounts Payable Services for Retailers

Account Payable Services is a one-stop solution for all your retail accounts payable needs

- Customized Pricing Models

- Increased Cash Flow

- 100% Data Security

- Improved Customer Service

- Qualified Accounting Graduates

- Quick Turnaround Time

Elevate Your Retail Business with Efficient Accounts Payable Outsourcing Solutions

At APS, we specialize in providing outsourced accounts payable services tailored specifically for the retail industry. Our account payable outsourcing solutions are designed to optimize your accounts payable procedures, enhance productivity, and improve your overall financial operations. With a deep understanding of the unique challenges faced by retailers, including high invoice volumes, multiple suppliers, and complex payment schedules, we offer comprehensive support that meets your specific needs.

Retailers encounter various challenges in accounts payable management that can be time-consuming, error-prone, and resource-intensive when handled internally. By outsourcing accounts payable tasks to APS, you can streamline these processes and focus on core activities, whether you are a chain store, an online retail business, or opening a new store.

Our team of seasoned professionals combines extensive knowledge of the retail sector with expertise in accounts payable management. We understand the importance of maintaining accurate financial records, timely payment processing, and building strong supplier relationships. With our accounts payable outsourcing services, you gain access to account payable services specifically designed to address the needs of retail businesses.

As your reliable partner in outsourcing your retail payables, APS ensures that your invoices are handled quickly and efficiently. We employ cutting-edge technology to manage the accounts payable step-by-step process, including validation, matching, and processing of invoices. This approach reduces the need for manual intervention, decreases errors, and allows you to concentrate on critical aspects of your retail operations, such as retail sales and managing retail store employees.

Accounts Payable Services We Offer To Retailers Industry

Reconcile Invoices to Orders

Reconciliation of invoices to orders ensures that retailers make accurate payments and avoid overcharges in their accounts payable processes.

Purchase Order Processing

Efficient purchase order processing helps retailers streamline procurement, ensuring timely payments and improved cash flow management.

Handling Debt Memos

Accurate handling of debt memos allows retailers to adjust payment obligations and maintain healthy supplier relationships.

Processing Monthly Sales Tax

Efficient processing of monthly sales tax in the accounts payable function ensures retailers remain compliant with regulations and avoid penalties.

Standard Pricing Information

Establishing standard pricing information aids retailers in processing invoices accurately and ensures consistency in retail pricing.

Processing Credit Memos

Timely processing of credit memos ensures that retailers account for any adjustments owed to suppliers, streamlining payment operations.

Preparing Expense Reports

Preparing detailed expense reports assists retailers in tracking departmental spending and supports effective accounts payable management.

Reconciliation

Regular reconciliation of accounts payable accounts helps retailers identify discrepancies and maintain accurate financial records.

Preparing and Processing AP Aging Reports

Regularly preparing AP aging reports enables retailers to track outstanding invoices and prioritize payments effectively.

Processing Monthly Account Payable Cases

Monthly processing of accounts payable cases keeps retailers’ financial records current and enhances operational efficiency.

Watch How Account Payable Services for Retailers Help You Grow

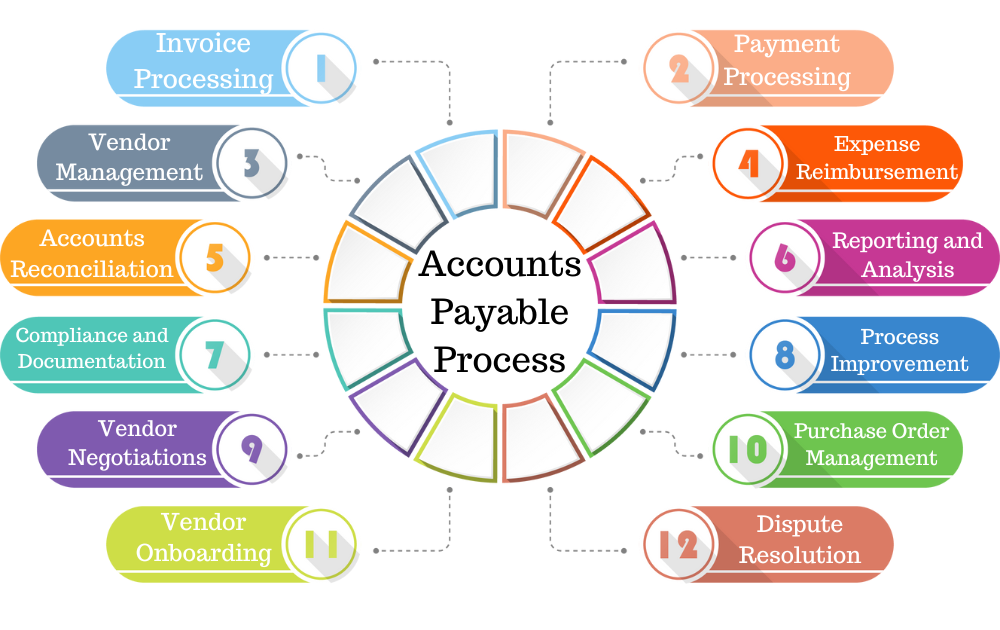

Accounts Payable Process

We Support Multiple Accounting Software

Our accounts payable outsourcing solutions integrate seamlessly with top accounting software like QuickBooks, SAP, Microsoft Dynamics, and many more, providing efficient accounts payable management and streamlining financial processes. With our expert team and advanced tools, we ensure accurate account payable services and full compliance, optimizing your business’s financial operations.

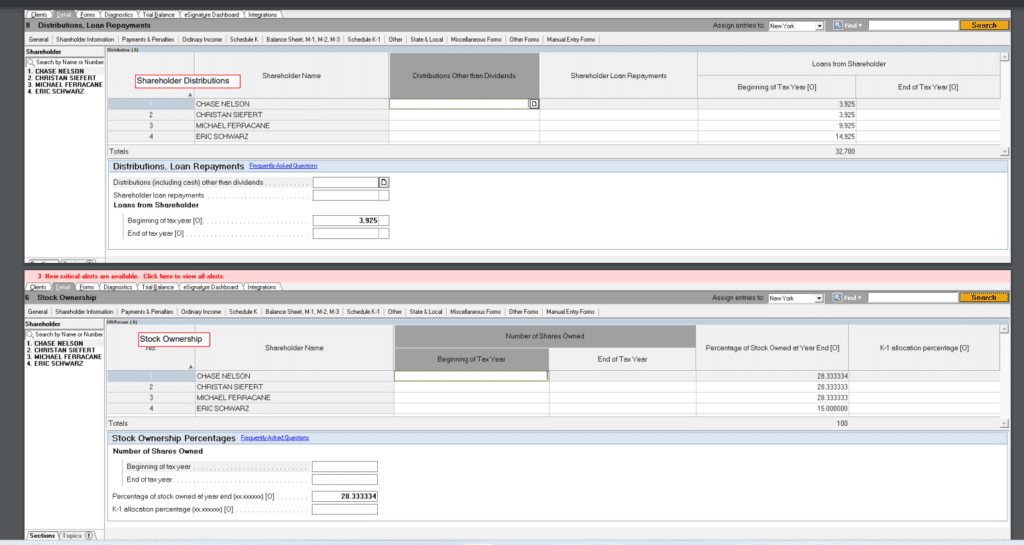

Our Accounting Portfolio

As a global provider of outsourced accounts payable services, we cater to businesses of all sizes across diverse industries. Explore our experience and see how we can help your business optimize financial workflows and achieve streamlined success.

Benefits of Outsourcing Accounting Payable Services Retailers

Why Choose APS?

At APS, our experts specialize in outsourced accounts payable services tailored specifically for the retail industry. We understand the unique demands, challenges, and dynamics faced by retailers, including managing complex payment schedules, high volumes of invoices, and vendor relationships. By partnering with APS, you gain access to market knowledge and skills that enhance your account payable outsourcing experience.

APS optimizes accounts payable processes to increase productivity and efficiency. Utilizing cutting-edge technologies and systems, we efficiently gather, validate, and process invoices, reducing manual work and eliminating errors to ensure smooth operations in your retail store.

Outsourcing your accounts payable needs to APS can result in significant cost savings for retail businesses. Our expertise, effective methods, and economies of scale help reduce operational expenses, allowing you to better manage cash flow, minimize workforce requirements, and allocate resources more strategically.

Maintaining strong supplier relationships is critical in the retail sector. APS guarantees timely processing of payments, adherence to payment terms, and effective communication with vendors. This proactive approach improves your cash flow and leads to favorable supplier terms, maximizing opportunities for early payment discounts.

The retail sector faces various legal regulations, including tax laws and vendor agreements. APS ensures strict compliance with these regulations by maintaining high standards of accuracy in all accounts payable services, including verification methods and precise data entry, safeguarding your financial integrity.

To protect your financial information, APS employs advanced security measures such as secure data transmission protocols and encryption. You can trust that your sensitive data is treated with the utmost confidentiality, ensuring safety from unauthorized access.

Recognizing that transaction volumes and operational needs fluctuate in retail, APS offers scalable and flexible accounts payable services to adapt to your changing requirements. Whether your business is expanding or contracting, we can adjust our services accordingly.

At APS, we prioritize exceptional customer service for our retail clients. We understand the importance of personalized care and proactive support, with dedicated account managers working closely with you to optimize your accounts payable management and ensure timely issue resolution.

Leveraging the latest technology and solutions, APS enhances the effectiveness and accuracy of your accounts payable processes. Our use of optical character recognition (OCR), and intelligent data capture minimizes manual errors and accelerates invoice processing.

Effective vendor management is crucial for retailers to secure favorable terms. APS serves as a single point of contact for vendor inquiries and disputes, providing negotiation support to help you achieve optimal vendor contracts and payment terms.

APS goes beyond basic accounts payable services by delivering strong analytics and business insights. Our detailed reports and dashboards offer valuable information about your financial performance, supplier trends, and payment patterns, enabling strategic growth and data-driven decision-making.

To protect your accounts payable operations, APS implements robust internal controls and risk mitigation strategies. Our proactive measures include fraud detection methods and stringent security protocols, safeguarding your financial interests against potential risks.

Dedicated to enhancing our offerings, APS continually evaluates its processes to maximize efficiency and customer satisfaction. By adopting best practices, we ensure your retail business benefits from the latest advancements in account payable outsourcing.

APS understands the importance of seamless integration with your current systems. Our team collaborates closely with your IT department to establish secure connections and data transfer methods, ensuring compatibility with your ERP, financial software, and other systems for unified financial operations.

Recognizing the unique challenges in managing accounts payable within the retail sector, APS provides customized solutions to address issues such as managing multiple store locations, franchise operations, and intricate supply chain negotiations. Our expertise ensures our solutions align with your operational needs and business goals.

Frequently Asked Questions

Accounts payable services refer to the management and processing of a company’s financial obligations to its suppliers and vendors. This essential function encompasses various responsibilities, including processing payments, validating invoices, managing vendor relationships, and maintaining accurate financial records. By efficiently handling these tasks, businesses can ensure timely payments and improve cash flow.

Outsourcing accounts payable services offers numerous advantages for retail companies. It helps strengthen vendor relationships, ensure compliance with financial regulations, reduce operational expenses, and enhance overall process efficiency. Additionally, outsourcing provides access to specialized knowledge, cutting-edge technology, and the scalability needed to adapt to changing business requirements. By outsourcing accounts payable management, retailers can focus on their core competencies while leaving complex financial processes to experts.

By outsourcing accounts payable services, retail companies can benefit from streamlined processes and advanced technology solutions. This partnership minimizes errors, and accelerates invoice processing, leading to improved overall efficiency. Furthermore, outsourcing grants access to specialized teams that possess in-depth knowledge of the accounts payable challenges unique to the retail industry, thereby facilitating smoother operations and better management of financial obligations.

Reputable outsourcing providers prioritize data security and privacy as part of their accounts payable outsourcing services. They implement robust security measures such as encrypted data transmission, controlled access protocols, and compliance with industry-standard security practices. Businesses must select a reliable outsourcing partner with a proven track record in safeguarding sensitive financial information to ensure the security of their accounts payable processes.

When outsourcing accounts payable services, retail businesses often engage a dedicated vendor management team that acts as the primary contact for suppliers. This team addresses vendor inquiries, resolves payment-related issues, and ensures accurate and timely payments. By delivering efficient payment processing, transparent communication, and prompt dispute resolution, outsourcing fosters collaboration and strengthens vendor relationships, ultimately benefiting the retail organization as a whole.

Our Key Differentiators

- Data Security

- High-Quality Services

- Highly Experienced Team

- Customized Pricing Plans

- Dedicated Supervisor

- Improved Customer Service

- 24*7 Support