Account Payable Services is a one-stop solution for all your startups accounts payable needs (US, UK, AU, CA, NZ)

- Customized Pricing Models

- Increased Cash Flow

- 100% Data Security

- Improved Customer Service

- Qualified Accounting Graduates

- Quick Turnaround Time

Streamline Your Startup Finances with Expert Accounts Payable Outsourcing Services

At APS, we specialize in providing comprehensive and unique accounts payable solutions, tailored to meet the specific needs of startups (US, UK, AU, CA, NZ). As your reliable partner, we are dedicated to streamlining your payable process and improving cash flow operations, allowing you to focus on growing your business.

We understand that startups operate in a fast-paced and competitive environment where every second and every dollar counts. Effective accounts payable management is critical for maintaining financial stability and building strong vendor relationships. Our wide range of AP services for startups includes expertise in invoice processing, electronic invoicing systems, and management accounts, all designed with startups in mind. Our solutions provide the tools and support necessary to navigate the complexities of accounts payable procedures seamlessly.

Our seasoned professionals bring a deep understanding of startup challenges, paired with industry knowledge. We recognize that time, resources, and experience can be limited for startups (US, UK, AU, CA, NZ). With APS, you gain a strategic partner committed to offering cost-effective solutions that streamline your startup accounts payable process, minimize risk, and support long-term growth.

From managing bill invoices to handling invoices in process and ensuring accurate payment terms, we take the complexity out of invoicing procedures. Our services include support for bills pay, bills receivable, invoice purchasing, and payment advice, ensuring a smooth and efficient payable system to keep your startup on the path to success.

Accounts Payable Services We Offer To Startups

Reconcile Invoices to Orders

For startups, we ensure alignment between bill invoices and purchase orders, helping you maintain accurate records in the payable process and preventing costly errors

Purchase Order Processing

We streamline purchase order processing for startups, ensuring vendor coordination and smooth invoice processing, helping you save time and resources.

Handling Debt Memos

We manage debt memos efficiently, ensuring any necessary adjustments or refunds are processed promptly to keep your startup’s financials in order.

Processing Monthly Sales Tax Reconciliation

Startups benefit from our sales tax reconciliation services, ensuring accurate and compliant reporting every month.

Standard Pricing Information

Our team provides startups with up-to-date standard pricing information, supporting informed decision-making and simplified invoicing procedures.

Processing Credit Memos

We manage credit memos for startups, ensuring refunds and adjustments are handled smoothly, improving your cash flow.

Maintaining Historical Records in the System

We maintain all financial records and payments, ensuring easy access for audits and future planning.

Preparing and Processing AP Aging Reports

We generate detailed AP aging reports to give startups clear insights into outstanding accounts payable, ensuring timely payments to maintain vendor relationships.

Processing Monthly Account Payable Cases

We handle the monthly accounts payable process, ensuring startups manage their bills efficiently, and helping you stay on top of your financial obligations.

Preparing Expense Reports

Our team prepares comprehensive expense reports for startups, simplifying your financial tracking and reporting for better management.

Payroll Management

We manage your startup’s payroll processes, ensuring employees are paid on time and financial records are kept up to date.

Countries We Serve

Trusted by Clients for Exceptional Results

EXCELLENTTrustindex verifies that the original source of the review is Google. APS makes smooth invoice verification process , vendor payment and documents record for our organization. Service provided by the them is highly appreciable.Posted onTrustindex verifies that the original source of the review is Google. Brilliant services.Posted onTrustindex verifies that the original source of the review is Google. We’ve been working with Account Payable Services for over a year now, and they’ve made a huge difference in how efficiently we manage our vendor payments. Their team is professional, responsive, and detail-oriented. Month-end closings are so much smoother now, truly one of the best outsourcing decisions we’ve made!Posted onTrustindex verifies that the original source of the review is Google. Very amazing services! Everything with them is made so easy and hassle free for me! Fixed my accounts, streamlined my investments and made my finances great!Posted onTrustindex verifies that the original source of the review is Google. Working experience with APS has been outstanding. Their team is highly professional, detail-oriented, and responsive. Invoice processing is smooth and timely, vendor communications are handled efficiently, and monthly reconciliations are always accurate.Posted onTrustindex verifies that the original source of the review is Google. Working with APS has been outstanding, I highly recommend APS for any business seeking reliable and scalable AP services.Posted onTrustindex verifies that the original source of the review is Google. Excellent servicesPosted onTrustindex verifies that the original source of the review is Google. Excellent services provided. Appreciate the quality work. 👍Posted onTrustindex verifies that the original source of the review is Google. Best services are provided here.

Watch How Account Payable Services for Startups Help You Grow

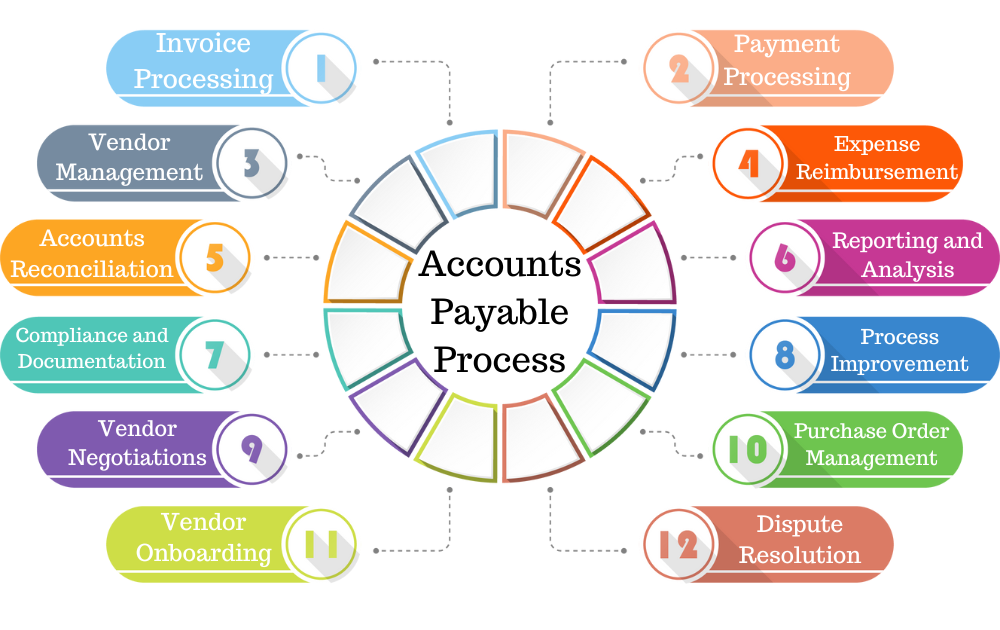

Accounts Payable Process

We Support Multiple Accounting Software

Our accounts payable outsourcing solutions integrate seamlessly with top accounting software like QuickBooks, SAP, Microsoft Dynamics, and many more, providing efficient accounts payable management and streamlining financial processes. With our expert team and advanced tools, we ensure accurate account payable services and full compliance, optimizing your business’s financial operations.

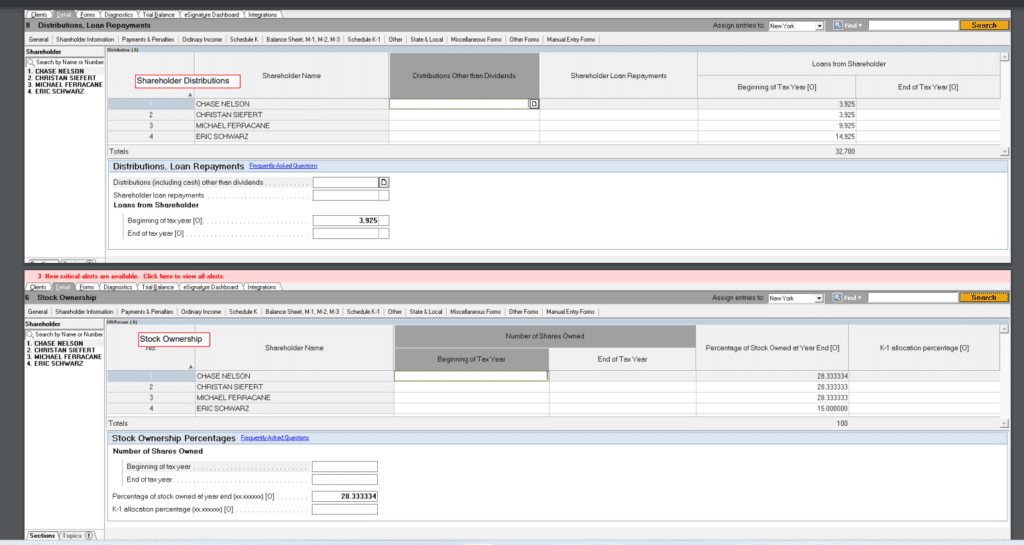

Our Accounting Portfolio

As a global provider of outsourced accounts payable services, we cater to businesses of all sizes across diverse industries. Explore our experience and see how we can help your business optimize financial workflows and achieve streamlined success.

Benefits of Outsourcing Accounting Payable Services for Startups

Why Choose APS?

At APS, we understand the distinct challenges that startups face in managing their funds. With extensive experience working with new businesses, we provide tailored solutions to address specific needs in accounts payable management. Our team applies industry best practices to ensure your invoicing procedures and payable process are efficient and aligned with your growth objectives.

By outsourcing your accounts payable services to APS, startups can significantly reduce operational costs. Our payable system utilizes electronic invoicing systems to drive cost-effective solutions without compromising quality. This allows startups to allocate more financial resources toward strategic initiatives while maintaining effective bill invoice management.

APS integrates cutting-edge technology to enhance the efficiency of the accounts payable process for startups. By eliminating manual data entry, minimizing paperwork, and speeding up invoice processing, we help startups reduce errors and delays. Our streamlined procedures ensure accurate payment terms, faster approvals, and improved cash flow management.

Startups often experience fluctuating growth and transaction volumes. APS provides scalable and flexible accounts payable procedures that can easily adjust to your startup’s changing needs, whether it’s an increase in invoice purchasing or expansion into new markets. This adaptability ensures continuous operations as your startup grows.

With APS managing your payable process, startups can focus on core business activities instead of being bogged down by time-consuming bill invoices and payment advice tasks. Our experts handle the routine accounts payable functions, allowing your team to dedicate more time to strategic growth, innovation, and customer satisfaction.

APS prioritizes the security of your financial data. Startups can trust us to implement robust security protocols and maintain compliance with industry standards. We ensure that your accounts payable procedures are not only efficient but also secure and compliant, reducing the risks associated with payment processing and data breaches.

We excel in managing vendor relationships for startups, ensuring seamless invoices in process management and timely payments. By maintaining excellent communication and quick dispute resolution, APS helps startups foster positive vendor relationships, essential for business continuity and operational success.

Startups can benefit from APS’s tailored accounts reports and in-depth analytics. We provide detailed insights into cash flow, vendor performance, and payable process efficiency. This enables startups to make informed decisions, identify areas for improvement, and strategically plan for future growth.

APS provides personalized customer support to startups, with dedicated account managers and support teams. We offer consistent assistance and resolve any issues swiftly, helping startups maintain smooth accounts payable operations while focusing on scaling their business.

Our deep expertise in accounts payable management ensures that startups receive solutions based on the latest industry standards. APS stays updated on trends and best practices, delivering optimized invoicing procedures and ensuring compliance with financial regulations. This expertise is critical for startups navigating the complexities of invoice processing.

APS supports startups by optimizing cash flow management through accurate payment terms, timely bill invoice processing, and efficient vendor communication. By ensuring uninterrupted cash flow, startups can better meet their financial obligations, seize growth opportunities, and minimize cash flow risks.

We work closely with startups to integrate APS solutions into your existing workflows and systems. Our seamless transition process ensures minimal disruption to your operations, whether it involves updating purchase order processing or managing historical financial data.

Startups partnering with APS gain access to advanced accounts payable technologies that would otherwise be costly to implement independently. Our solutions leverage new streamlined ways to improve invoice processing and overall efficiency, keeping startups competitive.

We offer scalable pricing models tailored to the budget constraints of startups. Our flexible pricing structures allow startups to access essential accounts payable services without overextending their financial resources. As your startup grows, APS’s pricing adapts to your increased invoice purchasing and payable system demands.

At APS, we continuously evaluate and improve the accounts payable procedures for startups. We identify bottlenecks, implement solutions, and drive ongoing process optimization, ensuring your startup benefits from efficient and sustainable financial operations.

For startups, maintaining compliance and being audit-ready is critical. APS ensures that your accounts payable procedures meet regulatory requirements. We maintain accurate records, prepare supporting documentation, and establish internal controls to ensure transparency and readiness for audits.

By outsourcing to APS, startups can focus on high-priority tasks and save time on invoice processing and bill payment management. This allows for greater productivity as staff can concentrate on driving growth and improving customer service.

APS has robust systems to mitigate fraud and errors in accounts payable management for startups. Our strict checks, validations, and reconciliation processes safeguard against financial losses due to mistakes or fraudulent activity.

APS strives to be more than just a service provider. We aim to be a strategic partner to startups, offering proactive solutions, industry insights, and guidance to support your growth goals.

Frequently Asked Questions

Startups should consider outsourcing accounts payable services to gain access to specialized expertise, cost savings, increased efficiency, and the ability to focus on core business functions. By leveraging accounts payable outsourcing, startups can benefit from expert assistance and advanced technology without the need for significant infrastructure investments or hiring additional staff. Outsourced accounts payable services provide startups with scalable solutions that grow with their needs.

Outsourcing accounts payable services can lead to significant cost savings for startups by reducing the need for in-house staff, lowering operating costs, and minimizing errors. Accounts payable outsourcing improves cash flow management through timely payment processes, better vendor terms, and strategic financial insights. These benefits help startups manage their finances more effectively and support growth and financial stability.

No, account payable outsourcing is beneficial for startups of any size. Even small startups can take advantage of outsourced accounts payable services as they offer scalability to match a startup’s growth. Providers like APS offer accounts payable services tailored specifically to startups, ensuring that each business receives the right support and expertise for its unique needs.

Accounts payable outsourcing is highly secure when working with reputable service providers. Companies like APS prioritize data security by implementing strong encryption methods, adhering to strict confidentiality guidelines, and following industry-leading security practices. This ensures that startups can trust their accounts payable services to be handled securely, reducing the risk of data breaches and ensuring compliance with data protection regulations.

Outsourcing accounts payable services does not mean losing control over your startup’s finances. On the contrary, outsourcing accounts payable can enhance financial visibility and control. Startups maintain oversight through real-time data access, detailed reporting, and open communication. By using outsourced accounts payable, startups gain accurate and timely financial insights, allowing them to focus on strategic planning and growth while staying fully informed about their financial health.